Homeownership might be considered one of life’s finest achievements. But not, outside of the pleasure out-of purchasing a home lays a low profile asset: household equity. Household collateral is the difference between the modern market price regarding a house and the a good equilibrium on one financial otherwise loan shielded loans Dinosaur CO against it. Leveraging it guarantee can help you by way of household collateral funds, taking property owners having accessibility fund for various purposes.

Whether it’s renovating the home, consolidating personal debt, otherwise financing significant expenses, house guarantee fund provide a handy cure for availability generous finance in accordance with the worth of the house. From the understanding the relationships ranging from home loans and you can household guarantee finance, property owners is effectively do the cash and you may open a complete possible of its possessions financing.

Facts family guarantee money

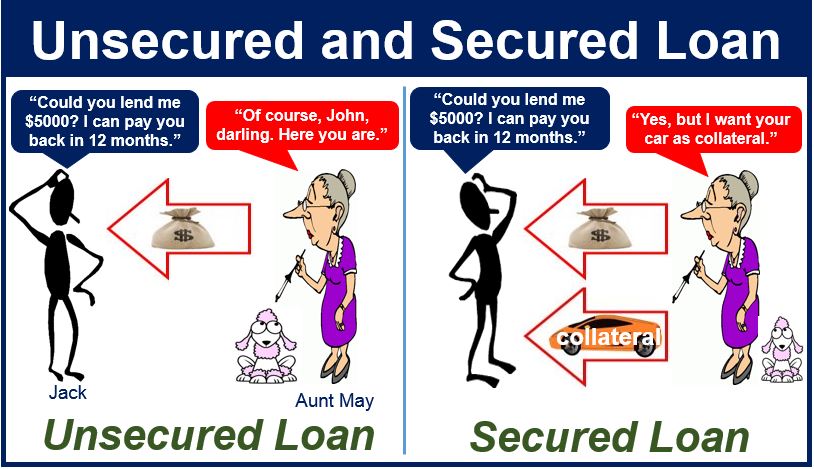

Home equity funds succeed residents to help you borrow secured on the fresh new guarantee they have built up inside their assets. The mortgage count is based on the difference between the brand new property’s market worthy of and you will any the home loan equilibrium. These types of finance offer the means to access fund a variety of motives, such family renovations, debt consolidation, otherwise big costs. Property owners typically repay the loan thanks to fixed monthly payments over a beneficial lay title, utilising their property given that equity.

Find the benefits of household security fund inside the India

- Competitive interest levels : Among the key great things about family collateral finance in the India is the competitive interest levels it offerpared for other kinds of capital, particularly unsecured loans or playing cards, home collateral fund generally feature lower interest rates. This makes all of them a nice-looking option for people seeking to borrow finance if you’re minimising the expense of credit.

- Versatile payment choice : Household guarantee finance offer borrowers which have flexible fees solutions. Dependent on their financial predicament and you can needs, consumers can select from some installment tenures. This autonomy allows homeowners to help you tailor the cost agenda to complement their demands, making certain that they may be able conveniently create their mortgage personal debt.

- Use of highest money : An additional benefit off domestic security loans ‘s the the means to access higher fund they supply. As the amount borrowed is determined according to research by the collateral dependent right up from the assets, property owners can use reasonable amounts of money. Should it be financial support home renovations, combining personal debt, otherwise investment biggest expenditures for example degree otherwise medical expenses, household collateral loans offer the economic independence needed seriously to target some requires and you will hopes and dreams.

- Income tax benefits : And additionally providing aggressive interest levels and versatile repayment alternatives, family guarantee money also come which have taxation benefits when you look at the Asia. Within the Tax Operate, borrowers is permitted allege write-offs on attract paid off on the household guarantee loan. These income tax benefits help reduce the general price of borrowing from the bank, making house equity money even more enticing having residents.

- Quick approval processes : Instead of various other types of financing, domestic guarantee finance often ability a simple recognition processes. Since the loan is shielded resistant to the property, lenders become more ready to stretch credit, leading to shorter acceptance minutes. For residents looking for immediate finance, so it expedited procedure would be a life threatening advantage, allowing them to supply the income they want as opposed to so many waits.

Ideas on how to sign up for home security financing from inside the Asia

- Take a look at guarantee: Assess the market property value your residence and you can subtract any a good financial or mortgage balances to select the offered equity.

- Lookup lenders: Look individuals loan providers providing household collateral money and you will examine their interest rates, conditions, and eligibility requirements.

- Assemble data: Collect the required records needed for the mortgage software, in addition to proof of name, address, income, property documents, and every other data files specified because of the bank.

- Apply: Finish the application for the loan function provided with the fresh new selected lender and you will submit they and the called for files.

Homeownership made easy which have Bajaj Homes Financing Financial

Now that you’ve know everything about domestic security financing, when you are eyeing possessions investment or even in need of loans for buying a home, take a look at Bajaj Casing Financing Financial. Designed to enable people in realising their homeownership goals, this type of financing promote a variety of has actually tailored to help with your travels, including:

Incorporate today or take the initial step for the turning their homeownership ambitions towards facts with Bajaj Housing Finance Financial.

Bajaj Finserv Software for all the Economic Demands and you may Requirements

Respected by the 50 billion+ consumers when you look at the Asia, Bajaj Finserv Application are a-one-stop solution for all the financial needs and you will wants.

Related Posts:

A created domestic area that’s a beneficial multifamily house is not thought a produced home for purposes of 1003

A created domestic area that’s a beneficial multifamily house is...

When you should prefer a houses otherwise fixer-higher mortgage

When you should prefer a houses otherwise fixer-higher mortgage Looking...

And therefore SA bank comes with the reduced interest to your lenders?

And therefore SA bank comes with the reduced interest to...